(pressing HOME will start a new search)

- ASC Proceedings of the 27th Annual Conference

- Brigham Young University-Provo, Utah

- April 18-20, 1991 pp 77-82

|

(pressing HOME will start a new search)

|

|

VALUE-ADDED TAX, A NEW TAX FOR THE 90'S AND THE CONSTRUCTION IMPLICATIONS

|

Brent Weidman Brigham

Young University Provo,

Utah |

| The

United States is in a serious financial situation that the people of

this country are going to have to face and solve in the near future. The

President and Congress are continually proposing methods to cut the

federal deficit, some of which directly affect construction operations.

There are only two problems with these proposals. First, they have yet

to make a significant dent in the deficit and second, because of all the

political controversies involved with any budget-cutting proposal, many

never get enacted. No group, including construction, wants to give up

something they currently have. Given this paradox of needing to cut

federal spending, and not being able to politically accomplish this, the

deficit continues to grow and problems increase.

One

solution being talked about is a value added tax (VAT).

The VAT is a consumption-based tax as opposed to an income-based

tax currently is use. The advantages, disadvantages, and implications to

construction and the economy in general of a VAT incorporated in the

United States are discussed and explained. |

INTRODUCTION

"Read

My Lips!" An important feature of President Bush's successful platform for

election in relation to taxes is being increasingly remembered. The newspapers,

magazines, and radio and television commentators are bringing this statement

back to the public's attention more and more as increased Federal funds are

needed. The talk and recent action of any tax increases or new taxes have been

extremely unpopular, even without the campaign platform of "no increased

taxes." However given the stubbornness of the federal budget deficit, many

feel that alternatives to spending cuts and debt increases must be found, and

found quickly.

The

American people are consuming more than they are producing, spending more than

they are earning, and borrowing more than they are saving. We as a nation are

rapidly approaching some tough decisions and consequences.

Legislators

are currently struggling with this problem of increased spending requirements

given a relatively fixed source of revenue from the existing tax system. It is

common to hear the American public agree that cuts in certain Federal programs

need to be accomplished, however the "song" tends to change when the

proposed cut affects a program that individually affects the "singer".

A universal attitude on the subject is that everybody is fond of the notion of

cutting out the other fellow's benefit, but his is defended as a necessary

investment which the government must protect to keep America strong. This point

can be seen daily as the lobbyists in Washington continually work to convince

the legislators that tax cuts in their area of concern would be devastating to

America as a whole. Business executives support proposals to eliminate farm

subsidies, the public in general wants to eliminate funds for educational

programs, farmers suggest eliminating low-interest loans to business, repeal of

Davis-Bacon wages are suggested, etc. Change is alright as long as it doesn't

negatively affect the one suggesting the change.

Given

that the United States needs to substantially decrease the growing federal

deficit, there seems to be only two viable alternatives. ither federal spending

is eliminated in some areas (which has been shown to be extremely difficult) or

a new and different source of revenue needs to be enacted. The second choice is

looked at by elected officials as committing political suicide. Congress is

continually being bombarded with ideas for new sources. The Income Tax Reform of

1986 was an attempt to broaden the base of tax revenues and equalize liability.

However, the US still sees the deficit rising due to inadequate revenues to

cover the spending. One of the worst ideas in recent tax policy debates was the

oil import fee. Motor fuel taxes are the best energy-related tax but are

unlikely to raise as much revenue as needed for deficit reduction, and cause

outrages from political groups as being unequal around the United States.1

Further the projected deficit figures are so staggering that spending cuts or

new specialized taxes of the size necessary to reduce or eliminate the fiscal

problem seem politically impossible.

This

proven inability to cut federal spending and the resultant prospect of

continuing budget deficits are driving the current effort to focus attention on

new revenue sources. One of the recommendations receiving much attention is what

has become known as the value-added tax. (VAT)

The

United states is one of the few developed countries that has not imposed a

value-added tax. This tax is sometimes known as a national sales tax, however

there are some differences as will be explained later. Over the past 30 years

approximately 50 countries have enacted some form of value-added,

consumption-based tax.2 These were designed to effect no substantial

change in the amount of revenues currently being collected, but were used as a

source of increasing revenue to the government. In other words they were not

replacement but additional taxes. Currently Japan is looking at the possibility

of installing a VAT in some form.

VAT--WHAT IS IT?

A

value-added tax is a broad based tax imposed on the value added at each stage of

the production and distribution of goods and services. s each stage of the

production process is completed, a VAT rate is applied to the value of the

production added, and a tax liability is assessed. his VAT is included in the

price that is assed on and paid by the buyer of the product. s an item moves

through the various stages of production and distribution, its value is

increased as a result of ach firm's activities in the process. For example, when

a firm acquires materials, supplies, and components and processes them using

capital goods, labor, and management, it adds to the product it sells. This

addition to the value of the product is the firm's "value-added",

which is computed simply as the value of its output less the cost of inputs it

purchases from other firms. The VAT then is the tax levied on the amount of the

value added. Firms at every stage--raw materials producing, manufacturing,

contracting, wholesaling, retailing--owe the government a tax assessed on this

amount of their value added. To avoid compounded taxation on value added each

producer receives a credit for taxes paid by the previous suppliers of a product

and only pays the difference. This

is best handled through an invoice credit method and is explained in the section

dealing with methods and types of VAT. The potential revenue producing power of

a VAT makes it readily apparent why this particular levy appeals to legislators

who look to higher taxes, rather than spending restraints. The VAT can be a

virtual money machine. It is estimated that it could bring in $25 billion in

this country for every percentage point of the rate. A 5 per cent VAT would

bring in enough to balance the budget in one year.3

The

VAT and the retail sales tax are both consumption taxes and eventually end up

being paid by the consumer. The two taxes are different, however, for

administrative reasons and because of differences in their tax bases.

A VAT is collected at each level of the business process, while a retail

sales tax is levied at the point of final sale. This means that a VAT would

require more paperwork and cause more administrative problems than a national

sales tax. At the same time, the dispersion of VAT collection would make tax

evasion more difficult and would ensure that any one violation be limited in

revenue effect. For example, any particular case of tax evasion under a VAT

would be limited to the level of production where it occurred, while a case of

evasion under a sales tax totally eliminates the potential tax revenue.4

Another difference is how both are viewed politically. Most states already have

a state sales tax, and probably would be hostile to having the federal

government infringe on this revenue source by adding a national sales tax. The

VAT could be administratively "hidden" much easier.

VAT--METHODS & TYPES

If

enacted in the US a VAT would likely be patterned after the value-added taxes

found in the European Economic Community (EEC). There are three basic methods

for determining the tax liability of a VAT: the subtraction method, the addition

method, and the credit (invoice) method.

In

Europe, the credit method is commonly used because it is the easiest to

administer. Taxes are applied to sales and services (output tax), and a credit

is allowed for taxes paid on purchases (input tax). A tax charged at a prior

stage in the production/distribution process is allowed as a credit at the next

stage. To obtain this credit a buyer must obtain a tax invoice, hence it has

become known as the invoice credit method. 5 The producer then is

responsible for paying that amount of calculated tax by taking the difference

between the output tax due and the input tax previously paid. This method would

use business invoices as the primary means to calculate taxes.

The addition method calculates tax liability by periodically summing all the components of value added: wages, profits, dividends, interest, rents, and royalties paid and then subtracting dividends, interest, rents, and royalties received. The difference is then multiplied by the VAT rate. The disadvantage of this method is that many businesses would have to change their entire record-keeping procedures to adhere to the system.

The

subtraction method is similar to the addition method in the records that would

need to be kept. A company would subtract the total of all purchased goods on

which it paid a VAT from its taxable sales. The tax would then be computed on

the difference.

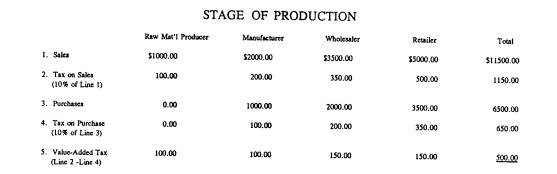

An

example of how the credit invoice method would work is shown in Figure 1 using a

VAT rate of 10 per cent. The table demonstrates that a VAT is a sales tax

collected partly at every stage of production. It also points out that the tax

is levied not on total sales at a given stage but only on the value added in

that stage.

|

| Figure 1 |

Just

as in any tax structure, certain exemptions would need to be allowed due to

administrative difficulties and reasons of public policy. It would be

administratively difficult to tax the consumption of owner-occupied housing, for

example, and inequitable to tax the consumption of housing by renters if

homeowners were not taxed. Medical care services and food consumed at home are

other examples of possible exclusions from the tax base for public policy

reasons.

Education,

religious, and welfare expenditures could have a zero-rated VAT because of their

spillover benefits to society in general. Zero-rated means that these

expenditures are not taxed at all. In effect, a rate of zero is applied to sales

and a full refund or credit given for tax paid on purchases. This would lead to

the establishment of multiple VAT rates which are common in the European

countries. Such exclusions as these would tend to ease the tax burden on lower

income groups. A conservative estimate of the realistic VAT base ranges from 45

% to 75 % of the personal consumption expenditures(PCE) due to exclusions."

6

POSITIVE CHARACTERISTICS OF A VAT

In

addition to its immediate and vast revenue producing power several other

advantages are stressed by those favoring a VAT. Proponents contend that it is

economically neutral because, at least ideally, it would be levied at a uniform

rate on all items of consumption. By treating all productivity alike, it avoids

taxing the profits of success more harshly than taxes on wages or interest on

savings.7 It does not distort choices among products or methods of

production. Therefore if a business shifts to a more capital intensive and

perhaps more profitable method of production the tax burden is not altered. The

allocation of resources across product, market, and industry lines is not

affected. In this aspect, the VAT is far superior to any existing array of

selective excise taxes previously proposed.

Advocates

also point out that a VAT, in contrast to our present income tax, has no penalty

for efficiency and no subsidy for waste. By focusing on consumption, it avoids a

double tax burden on the returns from capital.

In

theory, this tax starts off with no exclusions or exemptions and therefore

provides a broader and fairer tax base. One that the "underground

economy" or "tax evaders" will experience more difficulty in

finding ways to operate. As previously explained there are however certain

exclusions that are likely to be included.

The

fact that other nations have adopted a value added tax and that it is an

accepted form of revenue, fits in better than another form of tax with the

growing international character of construction. International construction

companies are currently exposed to such a system, and should be consulted by the

industry should such a tax be proposed. The VAT is becoming one of the revenue

workhorses of the world. A widely cited reason for adopting a VAT is the

anticipated foreign trade benefits. Under the General Agreement on Tariffs &

Trade (GATT), the treaty that sets international trading rules, a VAT can be

imposed on imports but rebated on exports.8 Unlike an income tax, a

sales-based tax can be imposed on goods entering the country and rebated on

items leaving. This supposedly would encourage exports and discourage imports.

This trend of thought, however, is suspect to the concept that fluctuations in

exchange rates would largely offset these initial effects and result in little

change in the balance of trade.

NEGATIVE CHARACTERISTICS OF A VAT

Besides

the obvious reason of a VAT being a new tax that the consumer must ultimately

bear the burden of, there are other concerns that opponents to a value-added tax

express.

They

contend that a VAT, just as any other consumption based revenue source, is

inherently regressive. Regressive in tax terms refers to the idea of fairness.

Fairness includes the notion that a tax burden should be distributed on the

basis of ability to pay. A VAT is assessed at a uniform rate for all. Total

consumption by households in all income classes would be taxed at the same rate.

Because consumption becomes a smaller share of income as income rises, a VAT

would be regressive with regard to income. Households in the lower income levels

would pay a larger share of their income in taxes than households in the higher

income brackets. This is similar to the concept that a basic 1400 square foot, 3

bedroom, 2 bath home costs more per square foot to build than a comparable 2000

square foot, 3 bedroom, 2 bath home. There are certain basic costs that first

need to be accounted for in both examples.

Due

to the regressivity of a VAT, proponents suggest that a VAT in the United States

be accompanied by some form of relief for low income families. An example of

such an exclusion would be to eliminate from the VAT base purchases of basic

consumption items. Lower tax rates on such items as basic commodities and higher

rates on luxury items are other possible solutions. The problem with this method

is in determining just what "basic" commodities are. In this day and

age, would a "Big Mac" be classified as a basic or luxury commodity?

Another

major concern is the inflationary force it would place on the economy. Even

though it would only be a one-time effect when the tax was initially enacted,

inflationary impact would be felt. Also it would have the effect of decreasing

capital formation and investment. 9

Many

concerns are voiced by those in state sales tax circles. Consumption based tax

has traditionally been the vehicle to raise state revenues and a VAT would

invade this area. This increased federal power is of concern to state funded

agencies and programs. They fear that adoption of a federal VAT could impinge on

their use of essentially the same revenue base.

The

advantage of how quick and effective a VAT would be in raising revenues is also

expressed as a major negative attribute by opponents. Conservatives fear that

Congress, given a new source of revenue, would be tempted to keep raising the

tax to fund new and expanded federal programs.

Other

concerns are administrative costs, increased record keeping for businesses,

technical problems associated with establishing the tax, and the selling job to

the American people that this new tax is necessary for the welfare of our

country.

The

answer to budget deficits, argue opponents to a VAT, is not to increase taxes on

citizens and administrative costs on businesses, but to significantly reduce

government spending. Balancing the budget cannot be accomplished by raising

taxes. It must be done by cutting the size of government, by eliminating

unnecessary programs, removing regulations, and lowering taxes. 10

VAT: ITS EFFECT ON THE CONSTRUCTION INDUSTRY

Just

as any new tax will raise the cost of doing business, the implementation of a

VAT will affect the construction industry by increasing the cost of the final

product.

Some

additional items company management will have to monitor and control are:

|

Construction

accounting will be least affected if the invoice method previously described is

used. For example, each time a supplier or subcontractor submits a bill to a

general contractor for payment, he would include a tax invoice stipulating the

amount of value-added tax he had been required to pay for his material or work.

The general would then deduct the value of all these tax invoices from the

amount of tax he is required to pay based on the contract or sales amount.

In

the estimating process, a new line item would need to be calculated showing the

tax paid for each previous organization completing work on a project as a credit

and then the amount of tax due from each succeeding organization as a cost. A

substantial amount of increased accounting effort would not be necessary to

comply with this method. It would merely be an additional invoice showing the

tax paid at each stage of the construction process. The ultimate consumer or

project owner would in effect be charged the cost of the tax by paying the

increased contract amount.

Many

construction projects may be exempt from a value-added tax. A government

project, whether it be federal, state, or local may have a possibility of being

exempt from the VAT for reasons of not taxing the entity that collects the tax.

Housing is another area to be considered for zero-rated or exempt status. If an

effort to alleviate some of the tax burden from the poor and to encourage single

family home ownership, tax relief could be given. The problem with housing is

drawing the limit of when a home is considered adequate shelter and when it

becomes a luxury living space. Such other "necessities" such as good

lie in the same category. Exempting "necessities" can certainly reduce

the regressivity but only at the price of seriously complicating the

administration by requiring sellers to make what are inevitably narrow and

arbitrary distinctions.

The

important point that construction company owners, suppliers, subcontractors, and

generals must become aware of is that should a VAT be introduced and passed in

the United States, it will be imperative that they understand the workings and

reporting requirements that will be established. It will become just like any

other cost item which will need to be calculated in the final price and paid for

with "real" dollars.

CONCLUSION

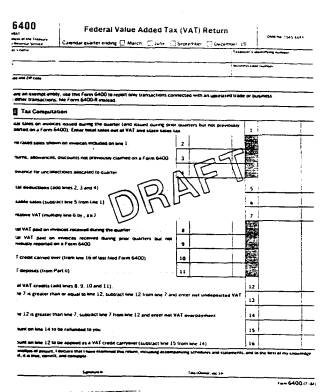

The United States government is in need of additional revenues in light of the political problems and, if not impossibility, of making significant cuts in government spending which currently exist. A VAT is one available source being talked about in tax legislation circles today. In fact, the IRS has prepared a draft of a value added tax return noted as Form 6400. (Figure 2) Rules for filing and other provisions are currently being drafted. Problems with a VAT such as regressivity and inflationary effects, as well as the other concerns mentioned, exist, but most likely can be mitigated or eliminated. Should a VAT be enacted in this country, i must be viewed as a long term change in the tax system and structure and not only as a temporary tax intended only to eradicate the deficit. It would most likely be based on the credit (invoice) method in which the final consumer will naturally bear the cost. If a VAT is enacted, the accounting profession would play a major role in advising companies and individuals on how they would be affected. Business managers, executive, and educators alike will certainly be used to assist in the compliance, education, and administrative aspects which would be required for implementation.

|

| Figure 2 |

The question yet remains, "Is there a VAT in the future?" very distinct possibility exists that some form of VAT will be enacted in the 1990's” 11 Very substantial public debate will be held before the American people are likely to support such an act as endorsing a new tax. The more informed we as a people are about the necessity and consequences of such a tax will determine its future. Everyone's business and personal lives will certainly be affected by such an occurrence. t is certain that the existing state of affairs in this great country will need to undergo some significant changes very soon if we are to continue to be the world's example. Whether these changes will be by choice or forced upon us will be up to the American people. It will be imperative that politicians, administrators, educators, contractors, business executives, down to the "man on the street" understand the implications and effect of such a potential tax. Without further study and research the long range implications to the construction industry remains in question.

REFERENCES

|