- ASC Proceedings of the 39th Annual Conference

- Clemson University - Clemson, South Carolina

- April 8-12, 2003 pp xx-xx

|

Using

Spreadsheets to Optimally Unbalance a Construction Bid

|

|

|

|

|

Spreadsheets’

use in construction is increasing due to their robustness and

versatility in automating a number of everyday tasks in the construction

industry. A number of

spreadsheet applications have been suggested to accomplish a wide array

of tasks including developing estimates quickly and accurately,

summarizing costs, presenting cost estimates details, analyzing and

controlling costs as well as data validation. This paper presents

another useful use of spreadsheets to optimally unbalance construction

bid prices. Unbalancing the bid is defined

here as bidding the cost items that are completed earlier on in the

project higher than the original marked up bid (i.e. balanced bid),

while bidding the items that are completed later on in the project lower

than the original balanced bid. The proposed spreadsheet

formulation can be used in real life as well as in teaching students

about bid unbalancing. The model can be used by professionals to

increase the profitability of their projects. By varying the different

parameters in the model such as the interest rate and the construction

schedule, students can examine the effect of all these variables on the

total project’s revenues. Key Words: bid unbalancing, optimization, spreadsheet applications, linear programming, cost analysis, present value |

|

|

Introduction

Many

contractors have spreadsheet program on their computer and their use in

construction cost estimating, cost analysis and control is increasing

(Carmichael 1997). While the possibilities for automating and customizing

spreadsheets are unlimited, they are mostly used to set up basic cost breakdown

summary sheets with basic formulas (Christofferson 2000). Christofferson (1999)

presented some helpful methods that convert basic spreadsheets into useful tools

to accomplish estimates quickly and accurately including setting up a summary

sheet, creating detail sheets, information lookup methods for estimating and,

data validation. This paper presents another useful use of spreadsheets to

optimally unbalance the unit prices on a construction bid. The proposed

spreadsheet application can be used by contractors in real life situations to

help in unbalancing their bids to maximize profits, as well as in a classroom

setting to teach construction students about the effects of bid unbalancing on

the profit. The remainder of this paper is organized as follows: bid unbalancing

is discussed in the next section. This is followed by a description of the

proposed spreadsheet model. The use of the spreadsheet model is demonstrated

through a simple example and the results are discussed. Finally, the conclusions

and recommendations for future developments are presented.

Bid

Unbalancing

When

bidding a construction contract it is important to consider the timing of

progress payments as well as the amount of the bid itself. The progress payment

schedule is directly related to the construction schedule since they are made

based on the actual work completed, less some holdback (or retainage). In most

cases, this results in the contractor incurring financing charges on the

negative cash flow for most of the project duration. Progress payment therefore

will have a significant impact on the amount of profit made. This is clear when

the time value of money is considered and the present worth of the progress

payment received is considered instead of just the cumulative sum of the

payments.

One

of the methods that the finance charges on the negative cash flow can be

decreases, and thus increasing the profit, is by unbalancing the bid. A balanced

bid is one where the actual costs and markups are accurately assigned to the

appropriate bid items for unit price contracts. Unbalancing the bid means

bidding the cost items that are completed earlier on in the project higher than

the original marked up bid (i.e. balanced bid), while bidding the items that are

completed later on in the project lower than the original balanced bid. This is

done while maintaining the same total price unchanged. This is sometimes

referred to as Front Loading the project.

Front

loading is widely practiced on unit price contracts. In

unit price contracts, the bidders usually provide a cost per unit for each line

item on the bid form. The total bid amount is summed up and the contract is

awarded based on the total combined bid. Unit price contracts are very common in

heavy construction such as highway reconstruction and rehabilitation projects.

Owners often use this type of contract when the exact scope and quantities of

the work to be performed cannot be accurately determined. This shifts the risk

to the contractor because of the inability to determine the exact quantities

ahead of time, since the quantities on the bid forms are not always accurate.

This is why most contracts include a renegotiation clause when the actual

quantities differ significantly from those on the bid forms. A contract clause

for example can read:

“Should

the total as-built quantity of any major pay item required under the contract

exceed the estimate contained in the proposal therefore by more than twenty five

percent, the work in excess of the one hundred and twenty five percent will be

paid for by adjusting the unit price…

(Hinze, 2001)”

On

the other hand, when the contractor knows from experience that there is a line

item that a particular owner usually furnishes himself and therefore has a high

probability of being eliminated from the contract, the contractor would deflate

the cost of this line item and inflate a cost of another earlier on in the

project. It is important to note therefore that the

risk increases tremendously if the contractor decides to front load the project

by unbalancing the bid, especially if the actual quantities differ from the

quantities on the bid form within the limit specified in the contract and the

contractor is not allowed to renegotiate the bid price. The contractor stands to

loose a significant amount of money if he/she unbalances the bid and then it

turns out that the quantities of those line items that he/she has inflated to

front load the project, are actually less than the amount on the bid form.

Unbalancing

can also occur on the schedule of values that the contractor is required to

submit in lump sum bids. The owner uses to this schedule of values to determine

progress payments to the contractor. The contractor would sometimes unbalance

this schedule of values to front load the project. By unbalancing or

front-loading the project, the contractor is in essence trying to get the

majority of her/her money at the earliest possible time. The contractor might

for example inflate the mobilization cost on the schedule of values and deflate

the cost of another item later on in the project. In other words, the contractor

is trying to increase the present worth of the payments from the owner. The

present worth takes into account when the payment is made, by considering the

time value of money. Therefore, the objective of bid unbalancing is to maximize

the present worth of the payments by changing the bid prices for the different

items within acceptable limits and at the same time keeping the bid price equal

to that of the balanced bid (i.e. the bid before unbalancing). In the next

section, the problem of maximizing the present worth of the progress payments is

presented.

Problem

Formulation

Bid

unbalancing have been addressed before in the literature (Ahuja and Campbell

1988, Stark and 1972). When there is a high degree of certainty regarding the

quantities furnished by the owner in the bid form for a unit price contract or

regarding the quantities and line items on a schedule of values, the bid

unbalancing problem can be formulated and solved as a linear programming

problem. Previous formulations of this problem, such as those in (Ostwald 2001,

Taha 2001), consider maximizing the present worth of the progress payments

received by the contractor. Mathematically this is expressed as:

|

|

When

unbalancing the bid there are two constraints that should be addressed. Firstly,

there is a constraint on the bid prices for the different line items themselves.

Although most owners will accept unbalancing to some extent, the owner can

disqualify a bid on the basis of obvious unbalancing [Hinze 2001]. The

instructions to bidders in most contracts include a clause that “if the bid

prices are obviously unbalanced, the owner has the option to reject the

submitted bid….”. The contractor needs to establish reasonable upper and

lower limits on his bid prices, so that the bid does not get rejected. This is

expressed as:

|

|

In

addition the present value of the progress payments cannot exceed the bid amount

in order to maintain the competitiveness of the bid. This can be expressed as:

|

|

The

linear programming problem formulated above can be solved manually using the

simplex method. However, an easier approach would be to model and solve the

problem using any commercial spreadsheet. In the next the proposed spreadsheet

solution is presented.

Problem

Solution

Spreadsheets

provide a transparent way of modeling the problem, giving the user a complete

understanding and control of the different variables and constraints in the

problem. For the majority of construction problems, whose size usually ranges

from small to medium, spreadsheet solutions are the most efficient and

economical method to solve the problem. Excel provides a solver add-in, which

can be used for optimizing such problems. In order to demonstrate the proposed

spreadsheet model, consider the simple project shown in Figure 1. The problem

presented here is adopted from (Ahuja and Campbell 1988). The project consists

of 4 main activities. The main objective is to determine the unit prices to

assign to each activity in order to maximize the present value. The proposed

solution to this model involves a 4-step process.

Step

One: Enter all the Required Data

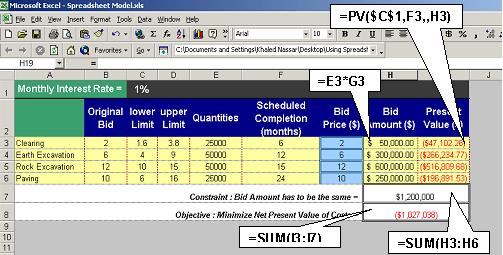

The

first step is to enter all the required data into the spreadsheet. As shown in

figure 2, the first and most important variable to consider it the monthly

interest rate that will be used. Here, a contractor could use the interest rate

that he/she expects to make on his/her money if the money was to sit in the

bank. Secondly the upper and lower limits on the bid price have to be set. These

values can be set from experience. Alternatively, a contractor could use the

maximum fluctuation in the bid price before the bid can be disqualified as

specified in the contract. The quantities and the scheduled completion values

for the different activities can be determined from the actual project’s

construction documents.

|

|

|

Figure

1: The

Gantt Chart for the Example Project |

Table

1

The

Example Project with Monthly Interest Rate at 1%

|

|

Original

Bid |

lower

Limit |

upper

Limit |

Quantities |

Scheduled

Completion (months) |

Bid

Price ($) |

Bid

Amount ($) |

Present

Value ($) |

|

Clearing |

2 |

1.6 |

3.8 |

25000 |

6 |

2 |

$

50,000.00 |

($47,102.26) |

|

Earth

Excavation |

6 |

4 |

9 |

50000 |

12 |

6 |

$

300,000.00 |

($266,234.77) |

|

Rock

Excavation |

12 |

10 |

15 |

50000 |

15 |

12 |

$

600,000.00 |

($516,809.68) |

|

Paving |

10 |

6 |

16 |

25000 |

24 |

10 |

$

250,000.00 |

($196,891.53) |

|

Bid

Amount has to be the same = |

$1,200,000

|

|||||||

|

Maximize

Present Value of Costs = |

($1,027,038) |

|||||||

|

| Figure 2: The Formulas Used in the Model |

Step

Two: Calculate the Present Value of the incomes

Once

all the data has been entered the present value has to be calculated. In excel,

the PV() function can be used to determine the present value of the progress

payment for each of the activities in the project as shown in Figure 2. The

present value function uses the bid amount (which is the quantity multiplied by

the bid price), the scheduled completion time (or the time actual time that the

payment is expected to be made), as well as the interest rate used. One can see

that the proposed formulas are fairly straightforward and therefore can be

easily utilized by contractors and understood by students. As formula (1) above

suggests, the present value for the total project is simply the sum of all the

present values of the different activities.

|

|

|

Figure

3: Solver

Parameters for the Model |

Step

Three: Setup the solver variable, constrains, and objective

In

order to solve this problem using the spreadsheet formulation we need to use the

excel Solver Add-in. The Solver Add-in can be used to optimize a wide range of

problems and is very robust and efficient in solving linear programming problems

such as the one at hand. Therefore, the third step is to run the excel solver

and maximize the present value of the progress payments. Figure 3 shows the

parameters used in the model. The changing cells (or the problem variables) as

well as the constraints as defined in the solver parameter dialog box. In

addition to the traditional excel solver, there are a wide array of other

commercial optimization add-ins available to handle larger problems. For

example, the genetic algorithm solver add-in works with existing Excel Solver

models to solve much larger problems up to hundreds of times faster.

Step

Four: Run optimization and analyze the results

The

last step is to run the solver add-in and generate the different solution

reports. Table 3, shows solver answers report. Important information about the

model can be extracted from this report. For example, it can be seen that by

changing the bid prices from their initial balanced values (the “Original

Value” column) to the new unbalanced values (the “Final Value” column), an

increase of about $15,000 in the present value is possible ($1,041,963 –

$1,027,038). This means that the contractor can make $15,000 more by the new

cash flow. In order to achieve this increase in this simple example, once can

see that the clearing and the earth excavation bid prices have been inflated to

the their upper limit while a tradeoff in the rock excavation and paving bid

prices has been reached. In addition, figure 4 shows how the interest rate

affects the present worth of the payments. Expectedly, an increase in present

worth can be achieved with a higher interest rate.

Table

3

Answer

Report Generated by Solver

|

Target Cell

(Min) |

|

|||||

|

|

Cell |

Name |

Original

Value |

Final

Value |

||

|

|

$H$8 |

Present Value

($) |

($1,027,038) |

($1,041,963) |

||

|

|

||||||

|

Adjustable

Cells |

||||||

|

|

Cell |

Name |

Original

Value |

Final

Value |

||

|

|

$G$3 |

Clearing Bid

Price ($) |

2 |

3.8 |

||

|

|

$G$4 |

Earth

Excavation Bid Price ($) |

6 |

9 |

||

|

|

$G$5 |

Rock Excavation

Bid Price ($) |

12 |

10.1 |

||

|

|

$G$6 |

Paving Bid

Price ($) |

10 |

6 |

||

|

|

||||||

|

Constraints |

||||||

|

|

Cell |

Name |

Cell

Value |

Formula |

Status |

Slack |

|

|

$H$7 |

Bid Amount ($) |

$1,200,000

|

$H$7=1200000 |

Binding |

0 |

|

|

$G$3 |

Clearing Bid

Price ($) |

3.8 |

$G$3>=$C$3 |

Not

Binding |

2.2 |

|

|

$G$4 |

Earth

Excavation Bid Price ($) |

9 |

$G$4>=$C$4 |

Not

Binding |

5 |

|

|

$G$5 |

Rock Excavation

Bid Price ($) |

10.1 |

$G$5>=$C$5 |

Not

Binding |

0.1 |

|

|

$G$6 |

Paving Bid

Price ($) |

6 |

$G$6>=$C$6 |

Binding |

0 |

|

|

$G$3 |

Clearing Bid

Price ($) |

3.8 |

$G$3<=$D$3 |

Binding |

0 |

|

|

$G$4 |

Earth

Excavation Bid Price ($) |

9 |

$G$4<=$D$4 |

Binding |

0 |

|

|

$G$5 |

Rock Excavation

Bid Price ($) |

10.1 |

$G$5<=$D$5 |

Not

Binding |

4.9 |

|

|

$G$6 |

Paving Bid

Price ($) |

6 |

$G$6<=$D$6 |

Not

Binding |

10 |

|

|

|

Figure

4: Solver

Parameters for the Model |

Conclusion

and Recommendations for Future Research

This paper presented a useful application of spreadsheets to optimally unbalance the prices. By bidding the cost items that are completed earlier on in the project higher than the original marked up bid (i.e. balanced bid), while bidding the items that are completed later on in the project lower than the original balanced bid, the overall profitability of the project is increased. The optimum tradeoff between the bid prices was achieved using the developed spreadsheet model and the solver add-in. A number of future extensions are proposed for the developed model:

| Addressing

the fact some contractors also unbalance their bids through manipulating

quantities. | |

|

The

fact that the quantities may change after the bid has been unbalanced. In

some cases there is great uncertainty about the quantities.

There is a possibility that

one or more line items will be canceled or that the owner will choose to

self perform some of the line items. In

other cases the contractor will be relatively sure that some items are going

to be deleted or added to the contract. | |

| Considering

the total cash flow, i.e. the contractor’s

expenditures as well as the incomes. A more accurate approach would

be to optimize the net present value resulting from the progress payment as

well as the contractor’s own expenditures. The contractor’s own expenses

would include his/her own cost to perform the work as well as other

associated costs like providing lien waivers for the different line items,

and other indirect costs. The goal of the optimization problem therefore

becomes to optimize the Net Present Value (NPV) for the project by changing

the bid prices. Alternatively one can consider optimizing

the bid in terms of the IRR instead of the present worth. Although the IRR

would give a more meaningful result, there is not close form solution for

calculating the IRR and therefore the problem may be harder to solve. | |

| Another

important issue to consider is the lien waiver amounts that have to be

provided by the contractor for the unbalanced bid items. | |

|

Incorporating

the schedule the retainage amount and the mobilization payment |

References

Ahuja,

H., Campbell, W., (1988) “Estimating From Concept to Completion,” Prentice

Hall Publishers, New Jersey

Stark,

R. M., and R. L. Nicholas, (1972) “Mathematical Foundations for design: Civil

Engineering systems,” McGraw Hill, New York

Philip

Ostwald, (2001) “Construction Cost Estimating and Analysis,” Prentice Hall

Publishers, New Jersey

Jimmie

Hinze, (2001) “Construction Contracts,” McGraw Hill Publishers, New

York

Hamdy

Taha, (2001) “Introduction to Operation Research, Prentice Hall

Publishers,” New Jersey

Christofferson,

Jay P. (1999) “ Using Powerful Spreadsheet Application Tools to Increase

the Efficiency and Effectiveness of Estimating”, ASC Proceedings of the

35th Annual Conference, California Polytechnic State University - San

Luis Obispo, California, April 7 - 10, 1999, pp 197 –204

Christofferson,

Jay P. (2000) “Estimating with Microsoft® Excel: Unlocking the Power for

Home Builders”, BuilderBooks Publishers

Carmichael,

J. (1997). 1997 Member Computer Study. Information Services Division,

National Association of Home Builders